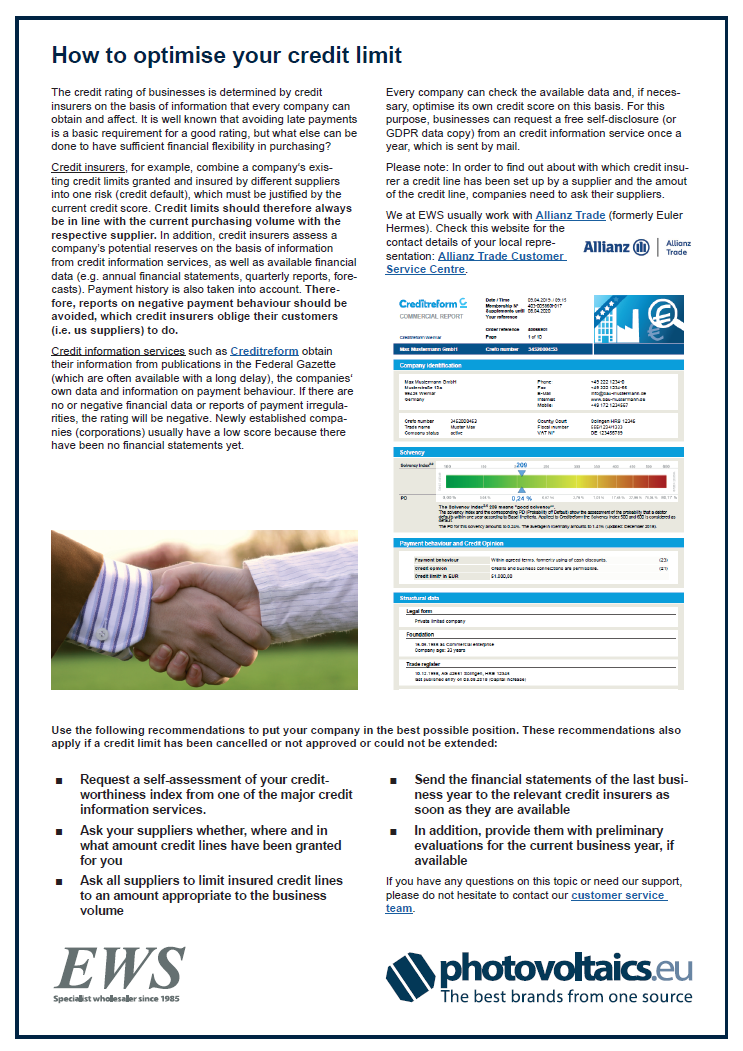

Many regulations and processes in everyday business life are confusing for entrepreneurs, including the topics of credit limits and rating. The assessment of the creditworthiness of commercial enterprises is drawn up by credit insurers on the basis of information that each company can influence actively. But how does this work exactly?

We have summed up the most important information for you in our fact sheet “How to optimise your credit limit", for instance:

- What is a credit rating and how is it measured?

- How does a rating come about?

- What is a credit limit?

- What do credit insurers do?

- Where can information on creditworthiness be accessed?

- What happens in the event of late payment?

- How can you optimise your credit limit?

These and other questions are being answered in our fact sheet which can be downloaded below. If you have any further questions, our team will be happy to help.